#

📊ㆍusual-strategies

This channel is for discussing and sharing DeFi strategies related to Usual (USD0, USD0++ ...). Whether you’re exploring new approaches or refining existing ones, this is the place to exchange insights and ideas. Remember to keep discussions focused, respectful, and aligned with our community guidelines.Page 3 of 4

BingChilling

yep as long as wait until maturity it is fine

621936

thanx bro i put in lp its says 93 days so ill wait till that time to see what i get

BingChilling

u are too comfortable getting rob by tether so u afraid high APY how do you think tether profit billions dollar every year ?

BingChilling

tether print billions and billions every year and pocket them for themself. usual use that revenue and distrubuted to usual

BingChilling

yep lp the most safu you don't need minmax and math

Usual

Faizan Ahmed

12/23/2024 at 11:41:18 ESTI am new here can somebody help me that why usual is giving so much APY?

621936

i think i go with lp

1272

🚀

Lot of early lps god rekt on IL so be careful

1272

Swap fees

Go to stake page, put your max USUALx amount in the USUALx text field, observe USUAL amount above, minus your USUAL deposit = your gain

Go to stake page, put your max USUALx amount in the USUALx text field, observe USUAL amount above, minus your USUAL deposit = your gainDraKryZ

Go to stake page, put your max USUALx amount in the USUALx text field, observe USUAL amount above, minus your USUAL deposit = your gain

KingArthur

USUALx rewards does not show on dApp dashboard ?

A9

USUALx daily rewards today: 0,56% of current min

KingArthur

when can i see the rewards amounts?

BingChilling

if you can hold until maturity i think so but that's divide by 12 and times 3 pool only last 3 months

matthias6763

Does it mean I get 40% additional yield?

BingChilling

more apy lol

matthias6763

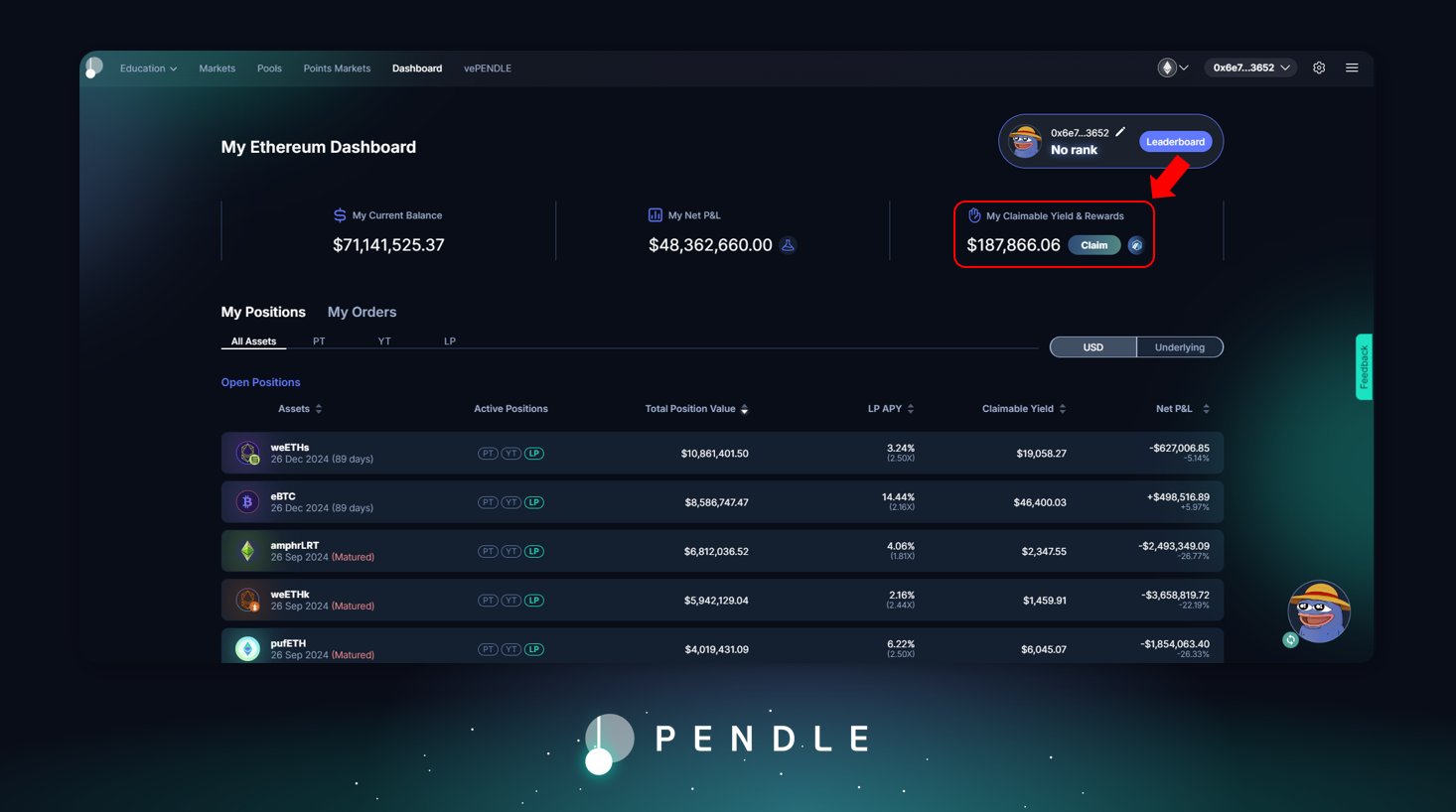

Pendle. Fi

Gunner funk

What's this platform?

matthias6763

Does it mean I get 40% additional yield?

usual -> stake in usual protocol u get usualx u get apy

usualx -> u add liqudiity pool in pendle fi u earn more apy (until march)

usual -> stake in usual protocol u get usualx u get apy

usualx -> u add liqudiity pool in pendle fi u earn more apy (until march)matthias6763

Whats the benefit to put usualx in pendle LP Pool?

Sama Do 👑

12/23/2024 at 04:24:56 ESTCuz i linked binance web3 wallet at usual website already

Sama Do 👑

12/23/2024 at 04:24:37 ESTNice, now to do this protocole think, i must download metamask wallet first ?

BingChilling

if you want 45 just take in protocol only is fine

Jose LB

12/23/2024 at 04:23:27 ESTTrue

BingChilling

yes so not worth it because u pay gas in eth

BingChilling

usual -> stake in usual protocol u get usualx u get apy usualx -> u add liqudiity pool in pendle fi u earn more apy (until march)

Jose LB

12/23/2024 at 04:22:53 ESTWith 15 days staked you are BE if you disscount the 10% tax

Sama Do 👑

12/23/2024 at 04:22:12 ESTI can stake for 45 day for exemple, but i need some understood for this stake note, and pandles

Ahaaa, and this pandle what means , and sorry for all questions 🥲

BingChilling

15 day is not enought unstake you pay 10% stake if for long term

Sama Do 👑

12/23/2024 at 04:19:57 ESTI want to stake ( for maybe 15 day) and get some usual coins more

What means pandle

BingChilling

yes and then if you want you like pendle you can add your usualx in pendle LP

Sama Do 👑

12/23/2024 at 04:17:34 ESTIs this the best way to stake ?

BingChilling

metmask is your defi wallet also need some eth to pay gas

BingChilling

u can withdraw to metamask wallet

Sama Do 👑

12/23/2024 at 04:16:41 ESTThis first thing right ?, i need all steps cuz iam new here

Sama Do 👑

12/23/2024 at 04:16:22 ESTOk what i understand is tgat i need to withdrowall my amount of usual to web3 wallet on binance

BingChilling

only simple earn earn basically nothing. u need to stake in usual protocol

Sama Do 👑

12/23/2024 at 04:13:13 ESTHow to stake usual coin from binance

BingChilling

i only buy YT when farming airdrop exchange my liquid to point hope the airdrop worth more

BingChilling

sophisticated product for YT need some phd in math lol. if you don't know what you are doing pt/lp is fine

Best of Cryptos

With the current situation, will it be profitable to buy Usual YT tokens?

Botanic

or just hold in your wallet to earn more auto-compounding xUSUAL yields on your staked USUAL

they are paid in USUALx, which you can unstake on Usual's DApp to USUAL or compound into more YT-USUALx on Pendle, or PT or LP USUALx on Pendle.

Botanic

YT USUALx rewards are on the Pendle position Dashboard https://x.com/pendle_fi/status/1836750161827242212

SAMSS

12/23/2024 at 01:45:26 ESTif I have a YT usualx position on pendle, how do I check my usual rewards on dashboard?

SatoshiXXX

Guys what is the formula for revenue switch?

cryptosfo

where is the link to mint USD0

Srsiti

because btc down

SHREW55

Why is price decreasing of USUAL

What is the relation between marketCap and TVL, also what is the relation between TVL and reward given for stackers ?

What is the relation between marketCap and TVL, also what is the relation between TVL and reward given for stackers ?Sama Do 👑

12/22/2024 at 17:11:58 ESTAnswer agent

Sama Do 👑

12/22/2024 at 17:11:40 ESTHow

How

Sama Do 👑

12/22/2024 at 17:10:57 ESTHow to stake usual

BingChilling

As long as tvl growing. Mcap will follow. Thats why you got miss price and opportunity.

What is the relation between marketCap and TVL, also what is the relation between TVL and reward given for stackers ?

What is the relation between marketCap and TVL, also what is the relation between TVL and reward given for stackers ?BingChilling

Tvl is the number that project growing. Marketcap itself is valuation of the project it could be up and down depend on market and risk apitite. Example btc at 15k is same fundamental with btc at 100k. Nothing is change.

Retyush | WolvesDAO

How much of USDO is staked as usd0++

What is the relation between marketCap and TVL, also what is the relation between TVL and reward given for stackers ?

What is the relation between marketCap and TVL, also what is the relation between TVL and reward given for stackers ?kiratsunami

What is the relation between marketCap and TVL, also what is the relation between TVL and reward given for stackers ?

Neckbeardius

Jeroom, I think the TVL may give an idea

What is the total amount / percentage of circulating supply of usualx that is currently staked?

What is the total amount / percentage of circulating supply of usualx that is currently staked?jeroom.eth

What is the total amount / percentage of circulating supply of usualx that is currently staked?

jeroom.eth

What are the parameters that impact the APY on usualx?

Neckbeardius

Double edged sword. lol...

jeroom.eth

Any plans to add the usualx rewards to the dashboard rather than when you unstake?

Neckbeardius

Yeah, showing the rewards would be beneficial. But I also like that you don't so people unstake and I get paid lol.

Makes sense, do you guys know when it will be possible to see the rewards in the dashboard?

Makes sense, do you guys know when it will be possible to see the rewards in the dashboard?jeroom.eth

Makes sense, do you guys know when it will be possible to see the rewards in the dashboard?

Should usualx be 1:1 to Usual? It seems to be better to buy usualx with usdc instead of usual.

Should usualx be 1:1 to Usual? It seems to be better to buy usualx with usdc instead of usual.kiratsunami

if you try and buy UsualX from uniswap it will cost you more than just buying usual so at the end it's the same thing

Should usualx be 1:1 to Usual? It seems to be better to buy usualx with usdc instead of usual.

Should usualx be 1:1 to Usual? It seems to be better to buy usualx with usdc instead of usual.jeroom.eth

Should usualx be 1:1 to Usual? It seems to be better to buy usualx with usdc instead of usual.

kiratsunami

they provide liquidity right and they get royalties out of it or the purpose is another one

kiratsunami

I'm more noob and more idiot thank you, I didn't reply to you because I was trying to understand what you wrote thx mate for the clarrification and always happy and thrilled to read your analysis or even if it's just your guts happy to read what you will write keep up the good work and thx a ton

JazzySt

I am thinking out loud and I should be speculating in the right place not here

JazzySt

It’s ok I was just thinking out loud lol

But mind you I’m a noob and an idiot reading these things

JazzySt

I have a feeling they played usual dirty and held on to more token with their insiders than they should have intentionally to manipulate the market

@treebeard can you read it well?

kiratsunami

why so ? how is the hot wallet any different from all the others ?

kiratsunami

whats GSR (MM), yeah forogot about uniswap

JazzySt

I saw this yesterday too but was shocked at the binance hot wallet tbh

JazzySt

Oh ok

You have them all circled

JazzySt

Which address?

A9

that's the UsualX address? interesting

I have no idea 😦 but probably its going to be divided by a lot more

yesterday apy was 1200 at 17% of the holders staking

its 800% today with 21% staking

I have no idea 😦 but probably its going to be divided by a lot more

yesterday apy was 1200 at 17% of the holders staking

its 800% today with 21% stakingA9

yeah think so these are the CEX addresses

A9

I have no idea 😦 but probably its going to be divided by a lot more yesterday apy was 1200 at 17% of the holders staking its 800% today with 21% staking

kiratsunami

if the % doubles can we say that the AYP will be divided by 2 ?

kiratsunami

thx bro

kiratsunami

how do you keep track of this ?

LN123321

yes did not increase

Marc

@AlphaKiwi

AlphaKiwi

How exactly is $usual price affected by treasury value?

AlphaKiwi

Is usual also getting the reward from staked RWA assets and distribute to $usual holders?

jellycat

what chain is usual on?

jellycat

what is the difference between usualx and usd0++?

AlphaKiwi

so what's the point of locking it for 4 year since I can still get usual reward if I redeem early?

A9

your current min didn't increase?

Is the 4 year locking mechanism online yet? I don't see anything about locking when staking USD0 to USD0++

Is the 4 year locking mechanism online yet? I don't see anything about locking when staking USD0 to USD0++AlphaKiwi

Is the 4 year locking mechanism online yet? I don't see anything about locking when staking USD0 to USD0++

AlphaKiwi

How can i receive risk-free yield in USD0 instead of usual token when I hold USD0++?

Zezzy

Check pins on general chat room

LN123321

it did not increase

LN123321

so i staked my usual yesterday and did not get any reward ...

A9

@LN123321

Zezzy

Lol, almost 21% of initial supply locked (supposed to be) in vault. Only 79% floating and we're still dip? I'll keep buying Usual.

Zezzy

And today it keeps increasing?

A9

was like 17% yesterday

Zezzy

Guys, do you know the currently proportion UsualX comparing to initial supply?

The apy going down means the total UsualX staked increases.

AlphaKiwi

where is the link entrance?

AlphaKiwi

Hi team, is the direct mint link using RWA still accessible?

besides pendle, are theer any other strategies I could potnetially use my Usualx or USD0++ for?

besides pendle, are theer any other strategies I could potnetially use my Usualx or USD0++ for?joeybagofnuts

besides pendle, are theer any other strategies I could potnetially use my Usualx or USD0++ for?

maybach_btc

Whales r weekly vesting for 6 months right guys

A9

you should see your min received increasing every now and then

kiratsunami

in 4h -75% from 915% to 854%

kiratsunami

damn another drop ...

LN123321

do you get your earn ? i started yesterday too and did not see any reward for my stake

kiratsunami

yes it did, do you know when did the stacking begun and how much it was before yesterday, I only started yesterday and i recall it was 1200%

LN123321

the apy for usualx dropped 400% after 1 day ...

LN123321

still not see my reward for staking usualx when i unstake ...

Gunner funk

When usd0 on aave?

kiratsunami

is it more profitable to stack Usual in usual app or in pendle ?

nguyen hung

you claim usual in pendle directly, not in usual dapp

kiratsunami

is minting USD0 means using the swap feature and swapping USDC into USD0 ?

kiratsunami

is minting USD0 same as stacking it ?

kiratsunami

Does the primary market refer to CEX and secondary market to DEX ?

MontyMaker

12/22/2024 at 05:58:54 ESTI started staking usualx , when do i get to see my rewards?

how does reward on usd0++ work if i juste buy usd0++ does the reward is attached to the wallet that hold usd0++ or i have to buy usd0 and stake it to have the reward?

how does reward on usd0++ work if i juste buy usd0++ does the reward is attached to the wallet that hold usd0++ or i have to buy usd0 and stake it to have the reward?Mr. Cooper

how does reward on usd0++ work if i juste buy usd0++ does the reward is attached to the wallet that hold usd0++ or i have to buy usd0 and stake it to have the reward?

Davinor

@Mava (AI Support) or is there no timeline yet for USD0 on CEX like Binance?

When will USD0 be available on Binance?

youdi

What is the time span or definition of every block ?

david_zhao.

Do I still receive the USUALX staking rewards through the platform

Thx, then what cost I have for having thses YT

david_zhao.

I have an question, If I buy UsualX YT in pendle, Do I still have these UsualX?

fmarquez123.

12/21/2024 at 23:55:12 ESTWhat chain is USUAL In? I want to buy and stake. Nice APY

cryptosfo

@Mava (AI Support) where is the link for direct mint

Where is the direct mint link ?

irwingtello

where i can buy usd0++

cryptosfo

how do I mint USD0 ? dont see a mint page, only swap

Magic Pan

is usual stake only available on ethereum?

Romeu

U N I SWAP USUALx/Usual, without the 10% fees lolll

Davinor

How can I switch between primary and secondary market in dapp?

Davinor

Which networks are supported for usual?

kiratsunami

how do you do that

Hello I have a question. I staked some USD0++ to see how it works. Reward is assigned to my wallet daily or periodically after some time. Is it possible to see somewhere my total reward from the day 0 to presence.

Hello I have a question. I staked some USD0++ to see how it works. Reward is assigned to my wallet daily or periodically after some time. Is it possible to see somewhere my total reward from the day 0 to presence.Bercianos

Hello I have a question. I staked some USD0++ to see how it works. Reward is assigned to my wallet daily or periodically after some time. Is it possible to see somewhere my total reward from the day 0 to presence.

hey everyone

if I want exposure to the growth of usual, what is the best strategy? Stake USUALx? Pendle YTs?

you guys probably figured it out already 😄

hey everyone

if I want exposure to the growth of usual, what is the best strategy? Stake USUALx? Pendle YTs?

you guys probably figured it out already 😄ndx

hey everyone if I want exposure to the growth of usual, what is the best strategy? Stake USUALx? Pendle YTs? you guys probably figured it out already 😄

DS

why USUALx in Pools in Pendle is not counting rewards?

Is not counting, but will be distribuited, right?

DS

USUALx in Pools in Pendle Counting to rewards?

Alexanderz🍀

I think 32 is overstated size

Is that mean can break even in two days ?

if I stake 4800 usual, how many token i will recieve daily ?? the forecast say 32 , is it correct ???

if I stake 4800 usual, how many token i will recieve daily ?? the forecast say 32 , is it correct ???LN123321

if I stake 4800 usual, how many token i will recieve daily ?? the forecast say 32 , is it correct ???

JazzySt

He got scammed in DM by fake a fake Noe not Noé

Usual

couendoy

God help me !

Gunner funk

What 50k

couendoy

50k dollars !!!! My god

Yeah. Because of the 10% fee unstaking is not advisable in the short term. Anyway Usual coins I believe will go stronger. What I only don't like is that I can't see what I have already earned.

Yeah. Because of the 10% fee unstaking is not advisable in the short term. Anyway Usual coins I believe will go stronger. What I only don't like is that I can't see what I have already earned.DrUky

12/21/2024 at 11:55:15 ESTyou can on debank

BingChilling

Because btc got rejected 100k. Its fine just buy december low. Trump inaguration speech could be bullish event for crypto

LN123321

the market is panic

jmyr

12/21/2024 at 10:49:43 ESTWhere’s secondary?

You can stake other place bro nobody force you.

Less people stake we got more apy anyway 😉

You can stake other place bro nobody force you.

Less people stake we got more apy anyway 😉 You can stake other place bro nobody force you.

Less people stake we got more apy anyway 😉

You can stake other place bro nobody force you.

Less people stake we got more apy anyway 😉SatoshiXXX

Exactly

I definitely know that the returns will decrease, but for a pool that has just opened for two days, with a 10% penalty and the drastic fluctuations in the token price, just to get 0.4% in a day? You really make people feel disgusted.

I definitely know that the returns will decrease, but for a pool that has just opened for two days, with a 10% penalty and the drastic fluctuations in the token price, just to get 0.4% in a day? You really make people feel disgusted.Srsiti

u can unstake via secondary without fee

I definitely know that the returns will decrease, but for a pool that has just opened for two days, with a 10% penalty and the drastic fluctuations in the token price, just to get 0.4% in a day? You really make people feel disgusted.

I definitely know that the returns will decrease, but for a pool that has just opened for two days, with a 10% penalty and the drastic fluctuations in the token price, just to get 0.4% in a day? You really make people feel disgusted.BingChilling

You can stake other place bro nobody force you. Less people stake we got more apy anyway 😉

JazzySt

USD0++ has a 7day verification before you can withdraw token but they’re there. You can swap USD0++ to USD0 without slippage.

Well, it's more about:

- USD0++ is stable rn, so there is no price exposure

- USUAL is a volatile token, so there is high price exposure (could be gain, could be loss)

Well, it's more about:

- USD0++ is stable rn, so there is no price exposure

- USUAL is a volatile token, so there is high price exposure (could be gain, could be loss)JazzySt

And USD0++ doesn’t have compounding of usual tokens so you get a set daily yield according to apy

But still staking usual tokens long run yields more than short term because of the 10% unstaking fee

But still staking usual tokens long run yields more than short term because of the 10% unstaking feePatriarch Reliance

Yeah. Because of the 10% fee unstaking is not advisable in the short term. Anyway Usual coins I believe will go stronger. What I only don't like is that I can't see what I have already earned.

Well, it's more about:

- USD0++ is stable rn, so there is no price exposure

- USUAL is a volatile token, so there is high price exposure (could be gain, could be loss)

Well, it's more about:

- USD0++ is stable rn, so there is no price exposure

- USUAL is a volatile token, so there is high price exposure (could be gain, could be loss)JazzySt

Thank you

Well, it's more about: - USD0++ is stable rn, so there is no price exposure - USUAL is a volatile token, so there is high price exposure (could be gain, could be loss)

JazzySt

But still staking usual tokens long run yields more than short term because of the 10% unstaking fee

@Noé am I right?

Long term stake USD0++ Quick short term turnover stake tokens

My answer is that it depends on what your goals are

Patriarch Reliance

Which is much profitable Staking $1000 USD0 Or Staking 1000 USUAL coins

Usual

SatoshiXXX

Im not the admin, just a staker like you

I definitely know that the returns will decrease, but for a pool that has just opened for two days, with a 10% penalty and the drastic fluctuations in the token price, just to get 0.4% in a day? You really make people feel disgusted.

I definitely know that the returns will decrease, but for a pool that has just opened for two days, with a 10% penalty and the drastic fluctuations in the token price, just to get 0.4% in a day? You really make people feel disgusted.SatoshiXXX

Calm down, why so angry with me, you can always unstake, sell your bag and go away

维尼熊杰克

I definitely know that the returns will decrease, but for a pool that has just opened for two days, with a 10% penalty and the drastic fluctuations in the token price, just to get 0.4% in a day? You really make people feel disgusted.

SatoshiXXX

You are wrong because you closed your mind

维尼熊杰克

I was wrong because this is the usual discord.

SatoshiXXX

I suggest you open your mind before judging this protocol. In my opinion, $USUAL is the best defi I've ever met. This could be your moonshot if you study this correctly

It is easy to understand for people like me that has past experience with pancakeswap etc

This is only a simplification, because usual emission is not fixed, but depends on few variables such as usdo++ tvl size

If there is more usual getting staked by more and more people, the apy goes down because the usual emission is fixed at 1,000 usual

Lets assume the usual emission is 1,000 usual per day to the usualx pool, it will be calculated for your apy and my apy

Usual staking apy is more like the apy from pancake swap

What are you referring to? Attracting users to lock their tokens with a 10% penalty and a fake APY, to facilitate market value management and allow the team to cash out?

What are you referring to? Attracting users to lock their tokens with a 10% penalty and a fake APY, to facilitate market value management and allow the team to cash out?SatoshiXXX

1st of all, looks like your understanding of the apy is coming from the aave (borrowing/lending protocol)

维尼熊杰克

Other projects' APYs are predictable and calculable, even if they are dynamic. Only yours has an exaggerated, fake APY

维尼熊杰克

What are you referring to? Attracting users to lock their tokens with a 10% penalty and a fake APY, to facilitate market value management and allow the team to cash out?

Davinor

There are also enough youtube videos explaining it. Information is available, but you have to take your time to search and understand it

SatoshiXXX

Actually for people with experience in defi, it is very clear

Davinor

It's compounding interest, for example you have a daily rate of 10% You start with 100, next day it will be 110, then 121, then 133 and so on. But the rate has to stay stable, which won't happen here, because more staked usualx will lower your share of the distributed usual.

维尼熊杰克

No one can explain it.

I know you're confusing us.

reverbb

12/21/2024 at 01:12:16 ESTBut the whole concept is for people to stake for years, not a couple weeks

if the rate continues to go down it'll be longer than 1 week but not by much

How do you figure that? people are continuing to stake which is driving the APY down, a week seems generous

How do you figure that? people are continuing to stake which is driving the APY down, a week seems generousreverbb

12/21/2024 at 01:11:05 ESTYeah it's just a crude estimate based on wallets that staked 2 days ago earning 1.5% daily.

JackNorris

It's not fake though... ?

JackNorris

How do you figure that? people are continuing to stake which is driving the APY down, a week seems generous

维尼熊杰克

How far can you go by attracting users with some eye-catching fake information

My issue is that even long term, given the popularity and rapidly dropping APY few will see breakeven

My issue is that even long term, given the popularity and rapidly dropping APY few will see breakevenreverbb

12/21/2024 at 01:04:15 ESTWhat you say is true but you should reach breakeven in a week or so. I have no idea if the debank figure is accurate but don't know why it would be incorrect

维尼熊杰克

How far can you go by attracting users with some eye-catching fake information

This output is ridiculously wrong

JackNorris

Also the debank figure cant really be trusted, the only one to trust is the output on the unstake page.

JackNorris

My issue is that even long term, given the popularity and rapidly dropping APY few will see breakeven

维尼熊杰克

You don’t understand what I’m saying at al

reverbb

12/21/2024 at 00:58:52 ESTI don't know about that. But are you going to withdraw at a loss? Staking is for long term holders

维尼熊杰克

If I want to withdraw , not from debank

Je ne comprend pas Le calcul, j'ai staké 3875 usual et il est marqué que cela rapporte par jour 27 usual et à l'année 47960 usual. Si on fait un calcul 47960 /365 =131 usual par jour. Alors pourqoi il y a marqué 27 usual par jour.

Je ne comprend pas Le calcul, j'ai staké 3875 usual et il est marqué que cela rapporte par jour 27 usual et à l'année 47960 usual. Si on fait un calcul 47960 /365 =131 usual par jour. Alors pourqoi il y a marqué 27 usual par jour.reverbb

12/21/2024 at 00:56:35 ESTcheck your wallet on debank. Seems it should give a different number

not 40

Putting in 8000 usual for over 30 hours, the APY dropped from 20000% to 1200%, and the profit of 40 usual is approximately 0.5%. Do you think this is reasonable?

Putting in 8000 usual for over 30 hours, the APY dropped from 20000% to 1200%, and the profit of 40 usual is approximately 0.5%. Do you think this is reasonable?reverbb

12/21/2024 at 00:55:42 ESTbut the debank says you earned 122 usual

Je ne comprend pas Le calcul, j'ai staké 3875 usual et il est marqué que cela rapporte par jour 27 usual et à l'année 47960 usual. Si on fait un calcul 47960 /365 =131 usual par jour. Alors pourqoi il y a marqué 27 usual par jour.

维尼熊杰克

I came in while taking the risk of a 10% unstaking penalty and the potential risk of the usual coin price dropping.

Can I take the minimum value when calculating the profit for 30 hours? That would be more than 40 usual, right?

Is it possible that the explanation rights belong to the project party?

JackNorris

Thats how APY works though, it's a compounding figure based on what you'd get in a year if it remained at the same level. Also the more people stake, the more the APY will drop.

维尼熊杰克

Putting in 8000 usual for over 30 hours, the APY dropped from 20000% to 1200%, and the profit of 40 usual is approximately 0.5%. Do you think this is reasonable?

JackNorris

How is it unreasonable?

ponziprawn

how do i farm usual with YT token ? do i have to stake it

Usual

ponziprawn

wait i dont see it, can someone help m e out

维尼熊杰克

Over 30 hours, the APY has dropped from over 22,000 to now, which is also unreasonable

hey guys, for the YT USD0++ Pendle pool, how do i stake my yt tokens ?

the APY is super high, im trying to stake it but i cant find teh button

hey guys, for the YT USD0++ Pendle pool, how do i stake my yt tokens ?

the APY is super high, im trying to stake it but i cant find teh buttonponziprawn

hey guys, for the YT USD0++ Pendle pool, how do i stake my yt tokens ? the APY is super high, im trying to stake it but i cant find teh button

维尼熊杰克

unreasonable

I have already correctly connected my wallet and cleared the cache, but the earnings I see are still only 37.94 usual (for 8000 usual staked for over 30 hours!). This means the earnings from usual are even less than USD 0++, which is completely unreasonable and hard to understand

I have already correctly connected my wallet and cleared the cache, but the earnings I see are still only 37.94 usual (for 8000 usual staked for over 30 hours!). This means the earnings from usual are even less than USD 0++, which is completely unreasonable and hard to understandreverbb

12/21/2024 at 00:04:57 ESThow many USUAL do you see when you check your wallet on Debank?

carbunclez

From my experience, it's not updated live on the website. You can use debank app to check your wallet address, which show live value of your wallet (to be safe, use another trash wallet to log in and search for your main wallet address). And yes, they showed the compound interest, so the earning will increase overtime. I was confusing and a little disappointed too.

维尼熊杰克

I'm not targeting anyone; I'm saying that all the scammers here are trash.

维尼熊杰克

you are right

Vagabond99

?

When will usd0 be launched on binance ?

Usual

I have already correctly connected my wallet and cleared the cache, but the earnings I see are still only 37.94 usual (for 8000 usual staked for over 30 hours!). This means the earnings from usual are even less than USD 0++, which is completely unreasonable and hard to understand

I have already correctly connected my wallet and cleared the cache, but the earnings I see are still only 37.94 usual (for 8000 usual staked for over 30 hours!). This means the earnings from usual are even less than USD 0++, which is completely unreasonable and hard to understand维尼熊杰克

I have already correctly connected my wallet and cleared the cache, but the earnings I see are still only 37.94 usual (for 8000 usual staked for over 30 hours!). This means the earnings from usual are even less than USD 0++, which is completely unreasonable and hard to understand

Why did I only earn 37.94 after staking 8000 usual for over 30 hours? This doesn’t seem reasonable! I checked the rewards in unstake

Why did I only earn 37.94 after staking 8000 usual for over 30 hours? This doesn’t seem reasonable! I checked the rewards in unstake维尼熊杰克

Why did I only earn 37.94 after staking 8000 usual for over 30 hours? This doesn’t seem reasonable! I checked the rewards in unstake

lapsang

Mava, where I can check DAO Treasury size?

How many days before you can claim your usual token that was at stake?

Why I don't see reflection of my earnings when I stake Usual to Usual ++

How many days before you can claim your usual token that was at stake?

Why I don't see reflection of my earnings when I stake Usual to Usual ++Patriarch Reliance

How many days before you can claim your usual token that was at stake? Why I don't see reflection of my earnings when I stake Usual to Usual ++

leha

Why I see no rewards of USUALx after waiting for 24 hours ?

Usual

JazzySt

# 📣ㆍannouncements

claiming airdrops?

JazzySt

Or claiming airdrops?

Usualx?

JazzySt

# 🤖ㆍtroubleshooting

Usual

joaojpl

Could any admin help me? I have a problem with the token claim

G10M 🍉

all the staking stuff are only on Ethereum network ? Nothing on Arbitrum ?

JazzySt

@Cat did you survive the scam?

The Southerner

Ah ok

JazzySt

No it was a team thing

Thanks, I was trying to test out the Mava AI bot. If I wanted the most exposure to USUAL, I would first buy USUAL and then buy USUALx?

Where can I get USUAL?

Thanks, I was trying to test out the Mava AI bot. If I wanted the most exposure to USUAL, I would first buy USUAL and then buy USUALx?

Where can I get USUAL?JazzySt

To get usual X you need to stake your usual tokens on the usual app official page. Please be aware that there is a 10% unstaking fee

The Southerner

The vote Scam

JazzySt

It deleted when I reported

The Southerner

Which Scam

JazzySt

You can get usual from different exchanges

Thanks, I was trying to test out the Mava AI bot. If I wanted the most exposure to USUAL, I would first buy USUAL and then buy USUALx?

Where can I get USUAL?

Thanks, I was trying to test out the Mava AI bot. If I wanted the most exposure to USUAL, I would first buy USUAL and then buy USUALx?

Where can I get USUAL?JazzySt

Sorry hope you didn’t click on the scam

JazzySt

@Noé repot scam

Cat

Thanks, I was trying to test out the Mava AI bot. If I wanted the most exposure to USUAL, I would first buy USUAL and then buy USUALx? Where can I get USUAL?

JazzySt

The staked usual is called usualx

Cat

What is USUALx?

Davinor

How long will it take till all Usual are released?

stiger

What is the practical usage of token usual ?

Davinor

Will we be able to buy Usual on the dapp?

Davinor

So everyones Usualx has an individual value to the holder?

Davinor

Where can I see the exchange rate for usual to usualx?

Davinor

Is there a fixed exchange rate for usual to usualx?

gm do you just need to hodl USD0++ to get the 80% APY? how often to rewards accrue? do you need to claim rewards?

gm do you just need to hodl USD0++ to get the 80% APY? how often to rewards accrue? do you need to claim rewards?chip

gm do you just need to hodl USD0++ to get the 80% APY? how often to rewards accrue? do you need to claim rewards?

jackguy

I just dropped a thread and dashboard looking at Usual metrics. Check it out, let me know what you think, and if you find it interesting, give it a share. https://x.com/PineAnalytics/status/1870191974298595755

JackNorris

APY is too low now to recoup the 10% any time soon

Alexanderz🍀

Unstake fee can eliminate ?

Best of Cryptos

No

loverdefi

Since we earn Usual tokens now and not pills, that's why I am asking

loverdefi

Does the referral program still work now sirs?

JazzySt

Whale mode lol

Davinor

So if someone holds 50.1 % of Usualx, he could decide everything?

Davinor

Is the voting power proportional to the amount of staked tokens?

weednoob

who gets protocol profits?

Davinor

Is there a minimal amount of tokens we have to hold for voting rights?

Davinor

Will we be notified if there is a vote?

Davinor

What do we need to hold for getting voting rights?

Aldezo

What does YT usual x provide you with?

Nani

cool so current 7 days verification period will end on which date? because i can't see any specific date mentioned anywhere.

Nani

is 7 days verification period for rewards is same for everyone or it varies to every users?

Dzerohash

what's the real apr of usualx right now? the frontend showing misleading figures

JazzySt

Utilize. # 🌎ㆍlanguage-select pour la langue française

The Southerner

What is the role of Pendle

220941

Je vais chercher mes enfants et après j'envoie ça

220941

Parce que j'ai compris que si je retire mes jetons il y a 10% en moins, mais la j'ai staker et plus de 10% on disparu

220941

C'est qoi le ss

C'est qoi le ss

Best of Cryptos

Will it be profiable to put it into the LP with YT mode enabled compared to just holding it in the wallet as staked USUALX?

220941

Je n'ai pas compris pourqoi j'ai moins de usual

J'ai staker 3875 usual ce matin et mon solde est de 3575 usual. Pourqoi il y en a moins ?

Do you speak freanch?

Hello

Best of Cryptos

I will be interested to know as well 🙂

What do you think about Pendle - USUALX pool? Will it be profitable to chose any of the PT, LP or YT over holding USUALX as it is?

What do you think about Pendle - USUALX pool? Will it be profitable to chose any of the PT, LP or YT over holding USUALX as it is?Best of Cryptos

What do you think about Pendle - USUALX pool? Will it be profitable to chose any of the PT, LP or YT over holding USUALX as it is?

JackNorris

anyone crunched the numbers?

Wow, pendle was fast

JazzySt

# 🤖ㆍtroubleshooting

Alexanderz🍀

I did not receive the daily reward

Is that fake , it already 24 hrs

chifoomi

And when are Usual emitted ?

Can someone please explain to me in simple terms where does the APY from USUALx comes from ? Thanks a lot.

Can someone please explain to me in simple terms where does the APY from USUALx comes from ? Thanks a lot.chifoomi

Can someone please explain to me in simple terms where does the APY from USUALx comes from ? Thanks a lot.

JazzySt

# 🌎ㆍlanguage-select

ok guys, I need to know what are the conditions to access the 'diamond hands" program. Is there a threshold ? When would it be activated if there are no thresholds? Should I wait to claim? Any pointer appreciated. 🙏

ok guys, I need to know what are the conditions to access the 'diamond hands" program. Is there a threshold ? When would it be activated if there are no thresholds? Should I wait to claim? Any pointer appreciated. 🙏famousfxck

Diamond hands is only for whales vesting

jbdzd

ok guys, I need to know what are the conditions to access the 'diamond hands" program. Is there a threshold ? When would it be activated if there are no thresholds? Should I wait to claim? Any pointer appreciated. 🙏

Lemoussu

You will have to wait a few days to be able to unstake without loss.

jko

no

JazzySt

It was never 1:1

Varoz

12/20/2024 at 01:31:03 ESTSo 1 USUAL is now 0.925 xUSUAL in "price"

Varoz

12/20/2024 at 01:30:46 ESTI see it is a 10% unstake fee and staking doesnt have a fee but xUSUAL is an appreciating asset, like stETH or something like this

JazzySt

Don’t unstake often…

Varoz

12/20/2024 at 01:13:58 ESTIs there a way to stake and unstake usual without eating an insane slippage?

You can see while unstaking I guess, so if we just try to do it, shouldn't it show the updated balance that we may receive?

You can see while unstaking I guess, so if we just try to do it, shouldn't it show the updated balance that we may receive?ASR

You can see while unstaking I guess, so if we just try to do it, shouldn't it show the updated balance that we may receive?

jko

u cant see reward for usualx

stampola

staked yesterday

I havent got it yet

ASR

Also, how much time did it take since the time of staking your usual?

Alright. Did anyone get rewards updated on usualx? How much percentage did you get? Was it added to the existing balance?

Proportion

debank (.) com

ASR

Debank?

ASH

whats the use of Usualx

sanuxo

oh nice

Proportion

Or its now shows on debank Total usual

@jko quick question..when you stake it said the rewards will show up in 24 hours..its been 28 hrs since i staked. I was testing out the platform to see how it works. I don't see the reward tokens showing. any idea?

@jko quick question..when you stake it said the rewards will show up in 24 hours..its been 28 hrs since i staked. I was testing out the platform to see how it works. I don't see the reward tokens showing. any idea?sanuxo

if you staked usual, they are not shown under "Pending Rewards", unlike USD0++ related rewards USUALx acts like a vault share: meaning, the increasing rewards reflect live when you try to unstake

@jko quick question..when you stake it said the rewards will show up in 24 hours..its been 28 hrs since i staked. I was testing out the platform to see how it works. I don't see the reward tokens showing. any idea?

@jko quick question..when you stake it said the rewards will show up in 24 hours..its been 28 hrs since i staked. I was testing out the platform to see how it works. I don't see the reward tokens showing. any idea?jko

maybe next cycle it will update

jij

@jko quick question..when you stake it said the rewards will show up in 24 hours..its been 28 hrs since i staked. I was testing out the platform to see how it works. I don't see the reward tokens showing. any idea?

Jeevan

just trying to get a hang of things

Hello everyone, new to crypto

Ziz

Got it thanks 🙏

Usual is listed on binance, I can see the price, can buy and sell. What about usualx, where do i see the price? What influences the price since its for the team so no one is buying or selling

Usual is listed on binance, I can see the price, can buy and sell. What about usualx, where do i see the price? What influences the price since its for the team so no one is buying or sellingZiz

Confusing 🙂

Usual is listed on binance, I can see the price, can buy and sell. What about usualx, where do i see the price? What influences the price since its for the team so no one is buying or selling

Usual is listed on binance, I can see the price, can buy and sell. What about usualx, where do i see the price? What influences the price since its for the team so no one is buying or sellingZiz

Usual is listed on binance, I can see the price, can buy and sell. What about usualx, where do i see the price? What influences the price since its for the team so no one is buying or selling

jko

which tradeable?

Ziz

Is it tradeable? How does it appreciate/depreciate in price? Or is it somehow pegged to usual?

jko

its for team

Ziz

What is usual*

flyingfish

actually i just hope that "Over time, governance will transition to a decentralized model centered around USUAL holders" is true but when I learned that some of them worked in politics this sentence sounds less trustable

the project seems cool I discovered it later that's why i'm having some issues giving my trust

the project seems cool I discovered it later that's why i'm having some issues giving my trust621936

Yeah I was late too . Bought on pre market . And also load some more before couple minutes .

deannguy3n

That is a bit old news. That is the whole marketing campaign I know 😜

Maybe they prefer to stay undoxxed . I didn't follow with founder thing . I saw this project read wp and it's all about giving back to ppl . As they said u never get reward form usdt or other stable coin .

Maybe they prefer to stay undoxxed . I didn't follow with founder thing . I saw this project read wp and it's all about giving back to ppl . As they said u never get reward form usdt or other stable coin .flyingfish

the project seems cool I discovered it later that's why i'm having some issues giving my trust

621936

I didn't know . I didn't follow that

flyingfish

they worked for the french politician that is currently running the country

621936

Macdonalds 🤣😅🤣

i invested that's why i'm seeking all the flaws even more when I learned where the founders worked before

i invested that's why i'm seeking all the flaws even more when I learned where the founders worked before621936

Maybe they prefer to stay undoxxed . I didn't follow with founder thing . I saw this project read wp and it's all about giving back to ppl . As they said u never get reward form usdt or other stable coin .

i invested that's why i'm seeking all the flaws even more when I learned where the founders worked before

i invested that's why i'm seeking all the flaws even more when I learned where the founders worked beforedeannguy3n

Where did he work before?

flyingfish

i invested that's why i'm seeking all the flaws even more when I learned where the founders worked before

621936

Did u invest or still sideline

flyingfish

talking about the number of special tokens owned by founders

621936

Wt u mean

Can anyone help me understand about unstacking USD0++. i tried stack then unstack quite freely (minus gas). But I read everywhere it said it should be lock for 4 years. So the lock start when? Does it lock after the 1st cycle? 7 days? After claming rewards?

Can anyone help me understand about unstacking USD0++. i tried stack then unstack quite freely (minus gas). But I read everywhere it said it should be lock for 4 years. So the lock start when? Does it lock after the 1st cycle? 7 days? After claming rewards?flyingfish

that changes everything those tokens are not that rare which is a good news

Can anyone help me understand about unstacking USD0++. i tried stack then unstack quite freely (minus gas). But I read everywhere it said it should be lock for 4 years. So the lock start when? Does it lock after the 1st cycle? 7 days? After claming rewards?

Can anyone help me understand about unstacking USD0++. i tried stack then unstack quite freely (minus gas). But I read everywhere it said it should be lock for 4 years. So the lock start when? Does it lock after the 1st cycle? 7 days? After claming rewards?Usual

deannguy3n

Can anyone help me understand about unstacking USD0++. i tried stack then unstack quite freely (minus gas). But I read everywhere it said it should be lock for 4 years. So the lock start when? Does it lock after the 1st cycle? 7 days? After claming rewards?

Myguy

12/19/2024 at 19:55:26 ESTHmm maybe yeah

flyingfish

do you know how many of USUAL* tokens are in this wallet ?

Myguy

12/19/2024 at 19:54:27 ESTWell if you unstake you get 10% cut

Myguy

12/19/2024 at 19:52:45 ESTSorry I meant just normal USUAL then

They'll just buy it off Binance and withdraw

Someone who wants to capture more yield will do one

ah ok I think it's cuz there are no whales do to so at the moment as they are all still vested

Why has someone not made a USUALx/USUAL* pool on Uniswap anyone know?

HEXTOR

12/19/2024 at 19:43:25 ESTWhen is the airdrop gonna happen?

flyingfish

yes but if you have 100$ of fees you give 50 to 1000000 people and 33 to 10 it's still a lot of power

CongQ

USUALx earns 50%, USUAL* only earns 33%

Indeed for now but the rewards are in USUAL so in power and the USUAL * holders will earn power on each Usual transaction as the rest is shared by more and more people so the fees will be a lot and they will be very few people looks like in the long run they will become as rich as blackrock

Indeed for now but the rewards are in USUAL so in power and the USUAL * holders will earn power on each Usual transaction as the rest is shared by more and more people so the fees will be a lot and they will be very few people looks like in the long run they will become as rich as blackrockCongQ

Even USUALx earns more than USUAL*

10% to all the insiders and founders and VC, that the least power I see in a genesis token in a long time

10% to all the insiders and founders and VC, that the least power I see in a genesis token in a long timeflyingfish

Indeed for now but the rewards are in USUAL so in power and the USUAL * holders will earn power on each Usual transaction as the rest is shared by more and more people so the fees will be a lot and they will be very few people looks like in the long run they will become as rich as blackrock

whatever I don't like what i'm reading about USUAL * this token gives too much power to the founders

whatever I don't like what i'm reading about USUAL * this token gives too much power to the foundersflyingfish

i really broke the bot

is usual open source ?

flyingfish

whatever I don't like what i'm reading about USUAL * this token gives too much power to the founders

flyingfish

i broke the bot

karinanob

I have gone through cycles before

cryptonite

so it is not too late too join

cryptonite

hi is there an airdrop program

Patriarch Reliance

If I stake USUAL is the APY constant or changing?

ghibly79

Can a human confirm xD?

ghibly79

No need to stake crv pools to get usual rewards, right?

puremood

The bot is really dumb. Suggest disable this bot. I think to see your accumulated rewards you have to take note of the convertability in the swap interface, and check back later to compare

flyingfish

what are the underlying Real-World Assets (RWAs) backing USD0++ ?

which are those RWA ?

flyingfish

does mass adoption wil decrease the apy of usd0++

flyingfish

what are the events that will increase or decrease the apy of usd0++

flyingfish

from where comes the money generated by usd0++ rewards ?

flyingfish

is it better to buy usual directly or keep them in usd0++ form in terms of apy ?

flyingfish

when you have USD0++ do you earn USD0 or USUAL tokens ?

Noé

Fyi: Morpho caps have been raised

няшка 0.0

How long does it take to transfer USUAL from Binance platform to web3 Binance wallet?

weaponmaster

12/19/2024 at 10:22:16 ESTRip bot is ded

weaponmaster

12/19/2024 at 10:21:06 ESTHow can I become a millionaire by staking USUAL ?

If I buy on Pendle the PT of USD0++ with an APY of 47%, I'll get lets say 10470 for 10000 invested. Is there an additional APY of USD0++ included or on top?

If I buy on Pendle the PT of USD0++ with an APY of 47%, I'll get lets say 10470 for 10000 invested. Is there an additional APY of USD0++ included or on top?Marcos

If I buy on Pendle the PT of USD0++ with an APY of 47%, I'll get lets say 10470 for 10000 invested. Is there an additional APY of USD0++ included or on top?

sanuxo

"USUALx acts like a vault share: meaning, the increasing rewards reflect live when you try to unstake. They are not shown under "Pending Rewards", unlike USD0++ related rewards"

DueDiliger

update every 24 hours

Alexanderz🍀

feel unsecured ...

DueDiliger

Any roadmap available ?

Alexanderz🍀

where is it show up for usualx coin stake?

where is it show up for usual stake?

Alexanderz🍀

when can i know i earn my daily stake ?

ASH

is there no dapp to monitor staking rewards of usual daily?

ASH

unstaking usual cost 10%? why

Alexanderz🍀

how can i know my reward after stake

няшка 0.0

So I just need wait some time for my tokens transfer to web3?

Alexanderz🍀

why the stake getting low

няшка 0.0

Why is my USUAL tokens not in my web3 wallet yet?

otgkbsmh

Daily in which timezone?

otgkbsmh

When does auto compounding happen on usualx?

Do one get LP rewards on top of holding rewards for USD0++ when providing liquidity to USD0/USD0++ pool on Curve? Or just the LP rewards?

Do one get LP rewards on top of holding rewards for USD0++ when providing liquidity to USD0/USD0++ pool on Curve? Or just the LP rewards?ghibly79

Do one get LP rewards on top of holding rewards for USD0++ when providing liquidity to USD0/USD0++ pool on Curve? Or just the LP rewards?

JazzySt

Hey. We wouldn’t be here if we didn’t see the potential lol

Staticmines

I see a potential future for this coin wbu?

Hey guys

colbobos

How to calculate it? any article?I wouldn't find it in docs

Protocol_guard

12/19/2024 at 07:17:03 ESTyes

JazzySt

English please

colbobos

Can staked usual boost my usd0++ apr

bosslin

大家好

Where do we see the rewards for the staked usual? Are they coming to pending rewards and can be claimed after one week? How do I know which rewards are coming from staking and which from Usd0++/LP?

Where do we see the rewards for the staked usual? Are they coming to pending rewards and can be claimed after one week? How do I know which rewards are coming from staking and which from Usd0++/LP?Noé

When you stake USUAL into USUALx, that USUALx acts like a vault share. This means that your rewards accrue and autocompounds, and you can see them when trying to unstake. Note that they do not show up under the classic "Pending Rewards", as opposed to USD0++ rewards.

denisft

According to the bots answer the rewards from different sources should be categorized separately but how can we see that?

Where do we see the rewards for the staked usual? Are they coming to pending rewards and can be claimed after one week? How do I know which rewards are coming from staking and which from Usd0++/LP?

Marcelツ

You guys think it will reach like 1.4-1.5 or sell now and buy more when low again?

JazzySt

Ok so anything like that I tag you? And what do I write

Noé

banned

galmoli

12/19/2024 at 04:36:22 ESTits a scam lol

JazzySt

Is it allowed

JazzySt

@Noé I meant this one

onebadday

gimme ur ss

weaponmaster

12/19/2024 at 04:22:58 ESTHave to wait at least 7 days before receiving my first staking rewards from USD0++

weaponmaster

12/19/2024 at 04:22:31 ESTNah I doubt the calculation

onebadday

how much usd0 do you hold?

Usual

JazzySt

It’s not working lol need to ask famous

JazzySt

/report scam

Rejeki

12/19/2024 at 03:21:32 ESTso what's the correct one?

jko

!report scam

jko

!report scam

Is there a market for usualx ? doc says they are transferable and permissionless, so capitalism should create a market, if they are worth anything

Is there a market for usualx ? doc says they are transferable and permissionless, so capitalism should create a market, if they are worth anythingFlorent Th

Is there a market for usualx ? doc says they are transferable and permissionless, so capitalism should create a market, if they are worth anything

xmb

Can usual be stacked only on the dApp or can it be stacked elsewhere

Elie Melchisedek

Hello, how much did you stake? And how do you do it?

Eva.Proko.SUPRA

12/19/2024 at 01:55:10 ESTUI is incorrect

Gyurci

Reallly?

Davinor

This won't be a fix amount. If if there are 1000 Usual emissions and you hold 10% of the staked usual, you get 100, but if there are now more stakers, you get less.

colbobos

How much additional usual can I get if I stake my earned USUAL rewards ?

colbobos

So if I staked 10 usual ,if I unstaked ,I only get 9 usual?

jko

no

kowalski

If i earn at $usual now at 12:00 will i get the reward to claim 24 hours after?

weaponmaster

12/18/2024 at 23:21:19 ESTDaily staking rewards of USD0++ is 35.0408 USUAL Do I have to wait a few days before claiming staking rewards, or can I claim them every single day?

weaponmaster

12/18/2024 at 23:14:38 ESTIs it easy for you to swap USD0++ back to USDC ? without restrictions ?

weaponmaster

12/18/2024 at 23:14:09 ESTHey man are you staking USD0++

Kobe<主动私聊的都是骗子>

Claim on dashboard

weaponmaster

12/18/2024 at 23:01:33 EST🤨 Bot is ded

What's the average fees to claim staking rewards today?

weaponmaster

12/18/2024 at 22:59:55 ESTDo I need to claim my staking rewards on the dashboard, or will they magically appear in my wallet?

weaponmaster

12/18/2024 at 22:58:12 ESTIs just holding USDO++ enough to receive daily staking rewards, or do I need to do something else?

weaponmaster

12/18/2024 at 22:55:09 ESTHey guys, is there anything like lock-period for holding USD0++ ? For example, can I swap USDC for USD0++, hold it for 1 week and swap back to USDC ?

Jamal Lyon💱⚓

12/18/2024 at 21:27:39 EST@ssddfsd yes

ssddfsd

is there a way to check your accumulated xUSUAL rewards throught contract?

It's annoying, it's not moving forward that I could confirm to stake, and around 70$ should be enough for the gas fee

It's annoying, it's not moving forward that I could confirm to stake, and around 70$ should be enough for the gas feeRobert Lewis💥AIT

12/18/2024 at 17:06:02 ESTIf you're having the gas fee in your wallet rn update your wallet portfolio and retry man

Davinor

It's annoying, it's not moving forward that I could confirm to stake, and around 70$ should be enough for the gas fee

puremood

lol. is there a way to check your accumulated xUSUAL rewards? when does it update?

puremood

but its autocompounded?

Kobe<主动私聊的都是骗子>

OK, try back when gas fee is low

Robert Lewis💥AIT

12/18/2024 at 16:50:58 ESTYou can try again since you've input more fee in your wallet

Davinor

Because normally I can engage the trade and see the fee, but not here

Kobe<主动私聊的都是骗子>

Gas fee problem

Robert Lewis💥AIT

12/18/2024 at 16:47:16 ESTYou sure you have enough gas fee??

Robert Lewis💥AIT

12/18/2024 at 16:46:07 ESTBlank screen?

Davinor

Metamask

Robert Lewis💥AIT

12/18/2024 at 16:45:50 ESTWhat's the pop up you got

Kobe<主动私聊的都是骗子>

Check your network

Davinor

Not really an error, but waiting for ages

Kobe<主动私聊的都是骗子>

Which dex wallet are you using metamask or trust?

Robert Lewis💥AIT

12/18/2024 at 16:44:07 ESTWhat's the error you got when you tried to stake

Kobe<主动私聊的都是骗子>

Hi

Davinor

Why can't I stake Usual from my wallet?

Davinor

Anyone knows why I can't swap USDC for Usual in MetaMask?

Can I buy Usual from Uniswap and stake it in usual dapp? I don't want to sell them on Binance and send usdc there if it doesnt

Can I buy Usual from Uniswap and stake it in usual dapp? I don't want to sell them on Binance and send usdc there if it doesntDavinor

Can I buy Usual from Uniswap and stake it in usual dapp? I don't want to sell them on Binance and send usdc there if it doesnt

AR

the fees coming for operate on ETH and yes you can buy (swap) from dapp with usdc erc20

No... it's 10% of the emission given to USUALx holders, right now there's less than 3% of the supply staked, so all stakers have a looot of rewards

No... it's 10% of the emission given to USUALx holders, right now there's less than 3% of the supply staked, so all stakers have a looot of rewardsJACH

Can i buy from the USUAL app? I dont want to pay high fees to send from Binance

621936

Market cap

davinci

How many Usual tokens can be farmed per day with 100,000 YT Pendle at the current ratio?

AR

where i can find the official contract for usual

AR

tyvm

621936

Wait till tomorrow

AR

atm the swap at uniswap its only 20usd

pau

eth fees are wild

go to dextools or dexscreener, find usual pool with millions in liquidity then you can see the correct usual contract

go to dextools or dexscreener, find usual pool with millions in liquidity then you can see the correct usual contractRaimy

remember to find the correct usual token contract

Raimy

bro withdraw usdc erc20 or buy eth and withdraw to your erc20 wallet then swap eth to usual on uniswap.

pau

i got USDC on my wallet, but how I can transfer them to USUAL app?

Raimy

withdraw ethereum then

pau

how I can do that? ERC20 is disabled con my exchange

AR

omg xD

Raimy

usual dapp kinda stuck, swap doesn't load lol

anyway whatever method you do make sure to paste the correct usual token contract and it will be fine

AR

sorry i mean usual dapp

Raimy

which dapp? I usually paste contract into 1inch dapp to swap, i don't use uniswap dapp

go to dextools or dexscreener, find usual pool with millions in liquidity then you can see the correct usual contract

go to dextools or dexscreener, find usual pool with millions in liquidity then you can see the correct usual contractAR

or just send usdc to wallet and swap it in the dapp no?

doesn't allow withdrawal yet, you have to sell to usdc or eth then withdraw then swap back to usual

doesn't allow withdrawal yet, you have to sell to usdc or eth then withdraw then swap back to usualpau

how is that?

Raimy

go to dextools or dexscreener, find usual pool with millions in liquidity then you can see the correct usual contract

AR

thks

Raimy

swap on uniswap pool

yes 100% ethereum

doesn't allow withdrawal yet, you have to sell to usdc or eth then withdraw then swap back to usual

doesn't allow withdrawal yet, you have to sell to usdc or eth then withdraw then swap back to usualAR

so its eth ?network ?

doesn't allow withdrawal yet, you have to sell to usdc or eth then withdraw then swap back to usual

doesn't allow withdrawal yet, you have to sell to usdc or eth then withdraw then swap back to usualRaimy

and also hope usual won't pump like 30% along the way lol

Raimy

doesn't allow withdrawal yet, you have to sell to usdc or eth then withdraw then swap back to usual

No... it's 10% of the emission given to USUALx holders, right now there's less than 3% of the supply staked, so all stakers have a looot of rewards

No... it's 10% of the emission given to USUALx holders, right now there's less than 3% of the supply staked, so all stakers have a looot of rewardsAR

how to move usual from binance for stake in the dapp ?

Noé

We don't "mint" out of thin air

AR

for sure dude

Raimy

if that's true we gonna see the second OlympusDAO or something like that lol

Raimy

thanks bro that's super clear now, so somehow it's a way to fomo newbie like me lol

still like 500% apr lol, anyway will stake for 1 day and see. but where can I see staking rewards? or it accumulates into my initial staking amount?

still like 500% apr lol, anyway will stake for 1 day and see. but where can I see staking rewards? or it accumulates into my initial staking amount?Noé

(assuming a daily compound)

Raimy

I know but when converted to apr still super high. For example staking 1000 $usual gives 500 $usual per day @@

Raimy

how will I receive the yield from staking $usual token?

Raimy

how will I receive the yield from usual staking?

Raimy

why staking apr for usual so high? is it UI error or true apr?

ANDRONYNE

12/18/2024 at 12:28:09 ESTSo if I want to stake, why would I go to arbitrum?

ANDRONYNE

12/18/2024 at 12:27:29 ESTIs there full functionality? Can I stake on arbitrum?

ANDRONYNE

12/18/2024 at 12:26:37 ESTSo I can buy usd0 on arbitrum instead of eth?

ANDRONYNE

12/18/2024 at 12:26:04 ESTHow do you avoid eth gas? I'm hearing stuff about arbitrum?

ANDRONYNE

12/18/2024 at 12:20:11 ESTAfter I spend tons on ethereum gas because devs are cringe

Ok boys. I have 20k to throw at this, how do I make the most money? I'm thinking put it all into usd0++ and stake for usual, then turn that into usual x

cue

"USUAL tokens can be staked or unstaked at any time without a mandatory lock-up period. However, the DAO retains the authority to impose an unstaking fee, applied as a percentage of the USUALx being withdrawn."

Arthur | Robbie

Send me a dm

Yes, staked Usual typically has a timelock period. Check the staking contract or platform documentation for the exact duration and conditions.

Yes, staked Usual typically has a timelock period. Check the staking contract or platform documentation for the exact duration and conditions.0xYushiko

do u have a link?

Capt 𝞃

kraken soon

Arthur | Robbie

Yes, staked Usual typically has a timelock period. Check the staking contract or platform documentation for the exact duration and conditions.

Arthur | Robbie

Yes, you can bridge tokens to Layer 2 networks to save on Ethereum fees. Use trusted bridges like Arbitrum or Optimism for seamless transfers.

jormpt

is there a timelock on staked Usual?

Virtus

Can we send usual tokens to any l2 to avoid ethereum fees all long ?

Kelvinerick54

12/18/2024 at 05:11:54 ESTClaim link

jko

further details soon

SPLop5K | CTH

USUALx will be a liquid token? Meaning, will be able to borrow against it?

hell0men

If USUALx will be in LP pair, will it still recieve the emission and fees?

fran_jpm

Just me or reward cycle stoped at 00:00:00 and no rewarded today?

unknown l

this has nothing to do with usual at all, ban

If USUAL price stay at this level, any YT currently can make a killer profit, but longer the time, higher the exposure to USUAL token price risk

If USUAL price stay at this level, any YT currently can make a killer profit, but longer the time, higher the exposure to USUAL token price riskthefurleyghost.

Got it. The part not quite adding up to me is the APY shown on longer term YTs is lower, lower APY with lower implied yield. With both YT earning the same rewards, lower implied yield would be lower price of YT, thus higher apy, no? What am I missing?

Srsiti

galxe just for fun

chandan861861

12/16/2024 at 08:55:20 EST18 dec claim date please reply

Mid December already done

chandan861861

12/16/2024 at 08:54:21 ESTToday dec 16

chandan861861

12/16/2024 at 08:46:07 ESTWhen galaxy allocation please sir

cue

Will my tokens remain in my wallet after pre-market ends?

CongQ

If USUAL price stay at this level, any YT currently can make a killer profit, but longer the time, higher the exposure to USUAL token price risk

Trying to understand why are the longer dated YTs are trading at lower implied yield? Will airdrop points or anything stop accruing yield at a certain date? Otherwise it seems buying YT at cheaper implied yield while getting the same rewards is a better buy? Anthing I am missing?

Trying to understand why are the longer dated YTs are trading at lower implied yield? Will airdrop points or anything stop accruing yield at a certain date? Otherwise it seems buying YT at cheaper implied yield while getting the same rewards is a better buy? Anthing I am missing?CongQ

Longer the time longer the uncertainty

thefurleyghost.

but otherwise all YT would earn the same amount of USUAL rewards, regardless of expiry date?

Trying to understand why are the longer dated YTs are trading at lower implied yield? Will airdrop points or anything stop accruing yield at a certain date? Otherwise it seems buying YT at cheaper implied yield while getting the same rewards is a better buy? Anthing I am missing?

Trying to understand why are the longer dated YTs are trading at lower implied yield? Will airdrop points or anything stop accruing yield at a certain date? Otherwise it seems buying YT at cheaper implied yield while getting the same rewards is a better buy? Anthing I am missing?thefurleyghost.

Trying to understand why are the longer dated YTs are trading at lower implied yield? Will airdrop points or anything stop accruing yield at a certain date? Otherwise it seems buying YT at cheaper implied yield while getting the same rewards is a better buy? Anthing I am missing?

cue

Why is APY so high with USD0++

cue

What do you mean after the campaign?

cue

If I stake USD0++, will I receive daily USUAL and be able to transfer it to another wallet?

1272

-30% apr to go long is not bad in a bull market

Edmilson

When the usual is released, will it be around 0.60?

SAMSS

12/15/2024 at 01:23:38 ESTwhich one? is it the april expire YT?

I would like to know the detailed calculation rules of usual daily airdrop quantity. Where can I get it?

I would like to know the detailed calculation rules of usual daily airdrop quantity. Where can I get it?didida

I would like to know the detailed calculation rules of usual daily airdrop quantity. Where can I get it?

1272

Lol who tf dumped their YT less than halfway to expiry. We take those

Robo-Odin

Could very easily boost the apy on the main LPs.

Especially with crv pumping.

Is it time for usual to stop direct incentivizing curve pools and bribing instead? It's like $2-$3 in emissions per $1 in vote incentives.

CongQ

Then you’ll have a buying opportunity of an RWA treasury bill real revenue-stream backed and redistribution token when it’s under 200M market cap.

Abdullah

I hope not

!Need2P

How to mine usual

ilo00o

Is it better to stake your token directly on usual app?

CongQ

you could say it's un$USUALly stupid

JazzySt

More to buy

Abdullah

What do you guys think. Can it reach 1.5$ or 2$ now immediately after launch?

Smutysmithy

12/13/2024 at 09:15:18 ESTIt’s funny how sentiment can change so quickly from super bullish to FUD in just 24hours 😂 I’d only start to FUD if TVL drops dramatically and it hasn’t.

JazzySt

Then why is premarket price at the lowest it’s been in days? If you looks at the money flow chart on binance it shows lots of selling

Srsiti

no one selling

piggy george

stop selling

why dump

couendoy

Thx for advice

Hello friends, far from starting the debate on human stupidity and liquidating the project, the reality is that the project is at 0.60 I bought full (40k tokens) at 0.31 what do you advise me? sell and buy back later or maintain thank you for your informed opinions

Hello friends, far from starting the debate on human stupidity and liquidating the project, the reality is that the project is at 0.60 I bought full (40k tokens) at 0.31 what do you advise me? sell and buy back later or maintain thank you for your informed opinionsNoé

# 🧐ㆍspeculation sir

JazzySt

Hold you don't need to sell

couendoy

Hello friends, far from starting the debate on human stupidity and liquidating the project, the reality is that the project is at 0.60 I bought full (40k tokens) at 0.31 what do you advise me? sell and buy back later or maintain thank you for your informed opinions

JZ

when will the $USUAL staking function launch?

Srsiti

yes

piggy george

before 20 dec?

piggy george

wen confirm claim time?

Hektor X

12/12/2024 at 14:39:42 ESTHow to transfer usual from binace to usual App after Spot trading is enabled?

0xMutated

or no claim on listing

0xMutated

Hello, when there are will be info regarding claim/vesting/drop?

xmb

Ok thanks so we will remain usual only 😐

Noé

unfortunately

Noé

Not planned for now sir

xmb

So how will we access the app as our region is restricted. Any third party stacking

xmb

Will the usual dApp be available on Binance

Noé

No, USUAL can't be staked on Binance directly, you'll have to do it through the Usual dApp

xmb

Can it be stacked at the exchange app like Binance

Hektor X

12/12/2024 at 11:46:36 ESTCan i stake usual Token?

Jimny2024

Is there Usual burning mechanism?

Srsiti

28 nov

brunoronam

When does the pills campaign end?

brunoronam

Is it worth buying YT from usdo++ today?

Srsiti

soon

piggy george

when cliam open?

damon

does current large lp' s usual reward have vesting mechanism ?

badman

so claiming happens in rounds you can't just claim it everyday

badman

when can I claim $usual tokens

Botanic

- green line = implied yield (YT price in APY terms) - blue line = current underlying USD0++ yield

To summarize: - implied yield = YT price in APY terms - underlying yield = what you earn per YT - long yield APY = spread between those two annualized (assuming yield per USD0++ remains stable until maturity)

what you refer to is the long yield APY, which is the annualized ROI of holding YT to maturity (assuming the underlying yields remain constant in average where they are now) Hence best to use this number as an indicator of whether YT is currently cheap or overpriced, rather than a guaranteed return. As this value can flutuate a lot with the spread of implied & underlying yield, which itself fluctuates with USD0++ TVL & USUAL market price.

hence the amount of YT you have x USUAL yields currently at 90% APY in USUAL token is what you earn per USD0++ or YT-USD0++

In Pendle, if I choose the January 30 pool and mint 10,000 USD0++ into 10,000 PT and 10,000 YT, I have the following questions:

Does PT generate any yield?

For the 10,000 YT, based on the official 60,000% APY, how many USUAL tokens would I earn daily?the page show yt-usd0++

In Pendle, if I choose the January 30 pool and mint 10,000 USD0++ into 10,000 PT and 10,000 YT, I have the following questions:

Does PT generate any yield?

For the 10,000 YT, based on the official 60,000% APY, how many USUAL tokens would I earn daily?the page show yt-usd0++Botanic

1 YT-USD0++ earns whatever holding 1 USD0++ in your wallet would earn

In Pendle, if I choose the January 30 pool and mint 10,000 USD0++ into 10,000 PT and 10,000 YT, I have the following questions:

Does PT generate any yield?

For the 10,000 YT, based on the official 60,000% APY, how many USUAL tokens would I earn daily?the page show yt-usd0++

In Pendle, if I choose the January 30 pool and mint 10,000 USD0++ into 10,000 PT and 10,000 YT, I have the following questions:

Does PT generate any yield?

For the 10,000 YT, based on the official 60,000% APY, how many USUAL tokens would I earn daily?the page show yt-usd0++cooperlee

In Pendle, if I choose the January 30 pool and mint 10,000 USD0++ into 10,000 PT and 10,000 YT, I have the following questions: Does PT generate any yield? For the 10,000 YT, based on the official 60,000% APY, how many USUAL tokens would I earn daily?the page show yt-usd0++

cooperlee

if. i. hold yt-usd0++, can i claim usual token everyday?

Candy Factory

12/10/2024 at 20:46:12 ESTWhen can we claim $usual tokens from USD0++

asot

@Mava (AI Support) is unstaking of USD0++ to USD0 currently supported?

@Mava (AI Support) is there any one-time minting reward for converting USD0 to USD0++ or only the continuous $USUAL yield?

@Mava (AI Support) is there any one-time minting reward for converting USD0 to USD0++ or only the continuous $USUAL yield?asot

@Mava (AI Support) is there any one-time minting reward for converting USD0 to USD0++ or only the continuous $USUAL yield?

Hektor X

12/10/2024 at 07:00:45 ESTI have now staked my USD0++. Are these now blocked for 4 years or can I unstake them at any time?

damon

how to get usd0?

damon

what is usyc ?

damon

how long is maturity period ?

damon

and we can only exchange usd0 to usdc , cann't redeem usd0 to usdc ?

damon

we can unstake usd0++ to usd0 instantly ?

Will YT rewards continue after the token distribution on the 12th, that is, after the 12th, how long will we receive YT rewards?

Will YT rewards continue after the token distribution on the 12th, that is, after the 12th, how long will we receive YT rewards?Black_Lotus

Will YT rewards continue after the token distribution on the 12th, that is, after the 12th, how long will we receive YT rewards?

Smutysmithy

12/09/2024 at 21:30:52 ESTYes I’ve done the maths but I’m not getting anywhere near those numbers in Usual rewards ?

Smutysmithy

12/09/2024 at 21:29:22 ESTLet’s say I have a positions in Pendle YT of $25000 at an average APY of 8393% what should my daily rewards in Usual be ?

Smutysmithy

12/09/2024 at 21:22:51 ESTDo Usual rewards have a daily limit per user ?

Smutysmithy

12/09/2024 at 21:20:00 ESTWhy is there no claimable yield on Pendle YT USD0++ ?

damon

usual reward for lp are distributed real time or ?

Personally, I highly recommend trading during Madrid, Spain time zones (UTC +1), which is where I have been able to obtain 200% profitability along with $USUAL, marking day trading operations or leaving them for 3-4 days, because every maximum of 5 days the price increases.

Personally, I highly recommend trading during Madrid, Spain time zones (UTC +1), which is where I have been able to obtain 200% profitability along with $USUAL, marking day trading operations or leaving them for 3-4 days, because every maximum of 5 days the price increases.EnanoForro

12/09/2024 at 20:54:13 ESTHi, send you a request to chat about your strategy. Just telling so u know I'm no bot xD

When you say community does it include traders in exchange platforms like Binance?

When you say community does it include traders in exchange platforms like Binance?Srsiti

in mid December

Patriarch Reliance